eric@defeasancegroup.com || 310-351-8500

Hidden Value

Reveal The Hidden Value!

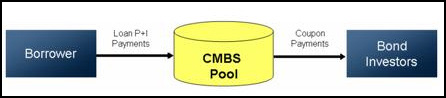

Commercial loans are packaged into a Commercial Mortgage Backed Security (CMBS) pool and are sold in the open market as bonds. Typically these loans cannot be prepaid early without a substantial prepayment penalty. This situation makes it less economically desirable for a borrower to refinance their loan.

Defeasance is a clause in the loan which allows the exchange of one type of collateral, such as real estate, for, another type of collateral such as a portfolio of United States Treasury Securities (“Defeasance Collateral”).

The existing loan remains in place while the principal and interest are paid by the Defeasance Collateral. The bottom line is that bond payments to CMBS investors continue unaffected.

The proceeds from a loan refinance or a property sale provide the source of funds used to purchase the Defeasance Collateral with any shortfall made up by the borrower.

Goal:

The remaining proceeds (after purchasing the Defeasance Collateral) are now available to the borrower.

The Defeasance Group | eric@defeasancegroup.com | 310-351-8500

Copyright © 2015 | Built By

REB Enterprises