eric@defeasancegroup.com || 310-351-8500

Process

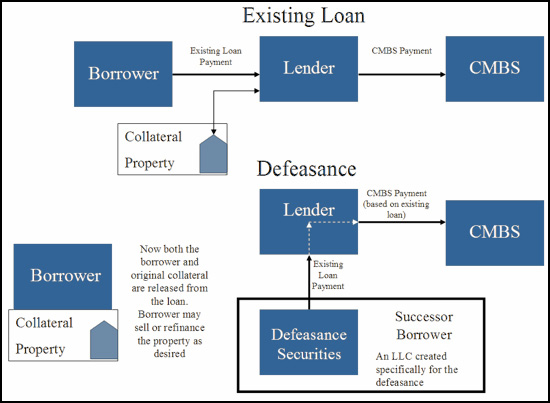

The borrower and property are released, through the defeasance process, from any obligations associated with the original loan.

A Successor Borrower enters the transaction and is responsible for purchasing the Defeasance Collateral (typically U.S. Government Obligations) with proceeds from the sale or refinance of the original property.

Securities purchased serve as replacement collateral for the real estate that once secured the loan. These securities are modeled so that the interest earned from them replicates the remaining payments due on the original loan.

A requirement of the Defeasance Collateral is that the portfolio must be sufficient to ensure that the loan payments are met through the loan maturity, as the original loan will remain in place. Defeasance does not prepay this debt.

The Defeasance Group | eric@defeasancegroup.com | 310-351-8500

Copyright © 2015 | Built By

REB Enterprises